- Routing #311982435

- Schedule an Appointment

- Contact Us

Trade in the Old, Cruise into the New!

- Routing #311982435

- Schedule an Appointment

- Contact Us

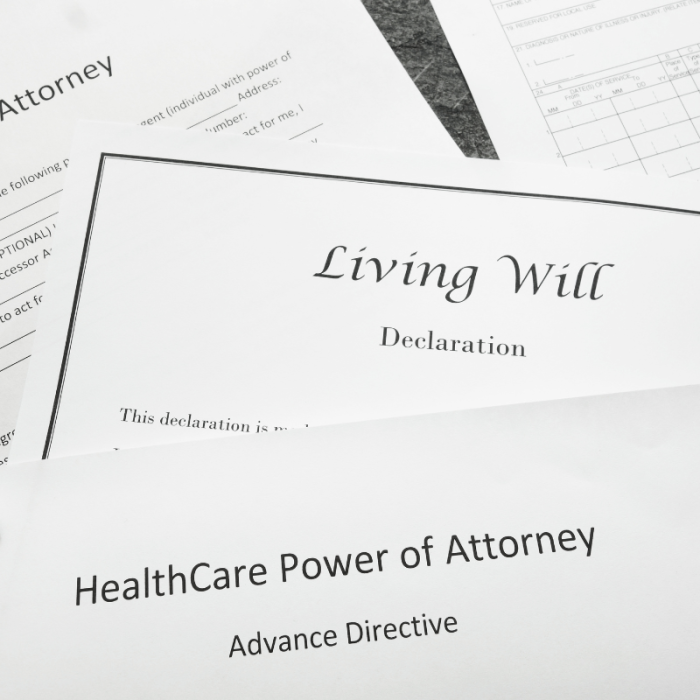

Digital Estate Planning

Getting your estate plan in order is an important task that many of us have not addressed yet for a variety of reasons. We'd like to help you with that.

Through a relationship that our trusted partner TruStage™ has with One Digital Trust (ODT), a leading provider of online estate planning solutions, America's CU is pleased to provide members with access to a subscription-based digital estate planning tool to create legally valid documents.

Goes beyond simply creating your basic will

- Creates important estate planning documents like your last will & testament, power of attorney, or a living will, even setting up things like a trust, guardianship for minor children, and directives for your pets;

- Automatically catalogs assets, debts, and important documents in a secure and customized digital vault that can be accessed and updated at any time.

- Provides a dynamic view into your overall financial standing and the ability to record and track any inheritance allocated to your loved ones.

TruStage™ is the marketing name for TruStage Financial Group, Inc. its subsidiaries and affiliates. © TruStage PRE-7523279.1-0125-0227

Wills and Trusts

Get Started

Create an Account

Register your account and begin creating your plan, starting with your basic will.

Get a sense of what this tool can offer before committing to the subscription payment.

Subscription Payment

Make a payment of $199 for a full 1-year access to create all the needed estate plan documents.

One price for all documents needed, including wills, trusts, power of attorney, etc.

Print and Save Documents

Download completed documents and secretly store them in the digital vault.

Print all documents that require notarization, then store them back in the vault after notarization.

Beyond the 1st Year of Your Subscription

Option to renew at $36/year to help ensure you can update your estate plan as your life changes and milestones are encountered.

Watch this short video to better understand Wills vs. Trusts. Learn what probate is, asset protection, and how to plan smarter for your future.

Need to better understand what estate planning is all about or if it applies to you? Unsure if this tool is the right product for you? The following can help you to sort through some of these considerations.

- What is an estate plan?

An estate plan is a set of legal documents that outline how your assets will be managed if you become incapacitated (i.e., unable to manage your own assets after an illness or injury) or pass away. Most estate plans consist of a will, or a trust, plus a durable power of attorney for finances, a healthcare power of attorney, final wishes, and a guardianship designation if you have minor children. Other aspects of an estate plan may also include things like making your wishes known about your funeral and adding a life insurance policy.

- What if I don’t need the tool after I create my estate documents – do I have to renew or can I cancel my subscription?

Within the first year of purchase, many customers create their basic estate planning documents, such as a living will. The advantage of keeping the subscription beyond that first year is the ability to update your estate plan to accurately accommodate for the life changes and milestones you and your family may experience.

However, if you feel that you got everything you need from the first year (ex. created a living will) and do not see additional value in renewing, you can elect to cancel your subscription prior to the renewal period.

- What’s included in this digital estate planning tool?

Creation of your estate planning documents, including:

- Last will and testament | Living will | Power of attorney | Pet trust and instructions | Guardianship directions | Final instructions | Instructions for property distribution and much more

- Storage of your documents in a secure Digital document vault | Estate plan documents you created | Title and deeds | Insurance policies | Pet trust and instructions

- Accessing your Estate Snapshot | Know where you stand at any given point with respect to your assets and liabilities, how they will be distributed, as well as a list of all those personal items that have been accumulated

- Do you have to be tech savvy to use this tool?

You don’t have to be tech savvy to use the estate planning platform. It is designed to be intuitive with a guided navigation experience that walks you through a step-by-step process. There are plenty of helpful tips and videos included along the way, as well as an email help line to answer any technical questions that come up.

- What if I have a complex estate, is this self-serve digital solution right for me?

If you have complex or large assets and holdings, seeking help from an estate attorney is a wise path to take in creating your estate plan. However, for Americans who have a straightforward asset structure, a self-serve solution like ODT’s could typically meet their estate planning needs.

- I don't believe I have an "estate." Why would I need an estate plan?

Some people may feel that estate planning is something that only applies to the wealthy or if there are large properties or expensive assets in involved. The reality is that everyone can benefit from having an estate plan. No matter the size of your estate, if you don’t have an estate plan, the decisions around how your assets are distributed are determined by the state in which you reside.

- Why is estate planning important?

If you pass or become incapacitated without an estate plan in place, your belongings will be administered and distributed according to the laws of the state you live in. This could mean that the distribution of your assets may not align with your wishes. This may place added emotional and financial burdens on your surviving loved ones.